Sid Bennett often cheats for big losers like Ted Fehr. For example, Sid folds, then looks at Ted Fehr's hand and sees a four-card heart flush. Quickly he grabs Ted's draw card--it is a club. Sid then rummages through the discards. Finding a heart, he switches it with Ted's club. . . . Ted smiles and wins the pot with a heart flush.

While Sid's card switch is crude and obvious, no one except John lets himself fully realize what happened. Later in the same game, Sid attempts a partnership with John. This is what happens:

The pot is large. Five players are in for the last bet-- including John and Sid, who are sitting next to each other. Sid bets and then his knee nudges John's leg. John promptly folds his three queens. Sid wins with a full house.

"Remember that," Sid whispers to John while pulling in the pot.

A few hands later, Sid Bennett is dealt a pat straight. Again he nudges John, who folds immediately. Sid grins and winks a faded-blue eye at John.

Later that evening, John draws to a lowball hand that he has bet heavily during the first round. But he catches a pair of fives to ruin his lowball hand. Still John bets the maximum in trying to bluff out his two remaining opponents.... Ted Fehr folds because Sid is sitting behind him with a pat hand. John's knee nudges Sid's leg. Sid smiles and then shows everyone his eight low as he folds. "Thanks," he whispers to John. Promptly John Finn spreads his hand face-up on the table to win the $600 lowball pot with a pair of fives.... Sid looks at the ceiling and sputters dirty words.

Instead of simply saying no to Sid's collusion-cheating offer, John earns a good profit while making his answer clear.

Professor Merck suspects Sid of cheating. One night, Sid cheats him out of a $700 pot. After sitting in silence for several hands, Quintin abruptly leaves without a word and slams the front door. Knowing that Quintin detected Sid's cheating and fearful that he will tell others, John pursues him out the door. Quintin stops under the street lamp when he sees John approaching. For a moment, neither says a word.

"You saw it too?" Quintin asks, squinting his green eyes.

"I see it in every game."

"So why haven't you said something!" the professor half shouts. "He should've been bounced from the game long ago."

"Look, who's the biggest loser in the game?" John quickly replies. "It's Sid. And you're a big winner. In the past couple of years, you've taken Sid for thousands of dollars. Sure he's cheated you, me, and everyone else out of pots. But what if we'd thrown him out two years ago? We'd have done him a $40,000 favor."

Quintin's mouth opens. He rubs his chin.

"Sid's a cheater and deserves to be penalized," John continues. "But the best way to penalize him is to let him play. We only hurt ourselves by bouncing him from the game."

"Never thought about it that way," Quintin says, scratching his head. "Maybe you're right.... Who else knows about his cheating?"

"No one who'll admit it. Cheating is a strange thing. Most players have strong feelings against acknowledging it.... Everyone subconsciously knows that Sid cheats. But no one wants an unpleasant emotional experience, so no one sees him cheat."

"Someday, someone will accuse him."

"Perhaps," John continues, "but visible suspicion will occur first. Take yourself--he cheated you out of $700 tonight. Yet, still you didn't accuse him. You passed it off till next time. The next time you may accuse Sid, or you may pass it off again."

"But what happens when someone does accuse him outright . . . what then?"

"If he's accused outright, we not only lose Sid, but other players might quit. The game might even fold. We must convince any seriously suspecting players that the best action is to let him play. If they won't accept this, then we must either stop the cheating or eliminate Sid from the game."

"So for now, we leave everything as is?"

"Right," John replies with a nod. "And when Sid steals your pot, just remember he'll pay you back many times."

"But why is he a big loser if he cheats?"

"A cheater, like a thief, is unrealistic. He overestimates the value of cheating and plays a poorer game. In fiction, the cheater may be a winner. But in reality, he's a loser, and usually a big one. The good player--the winner--never needs to cheat."

"True, true," Quintin mumbles.

"See you next week," John says as he walks away.

What does John accomplish by his discussion with Quintin? He keeps the game intact by pacifying Quintin, and keeps Sid in the game to continue his cheating and losing.

The good player can lose to cheaters in certain situations. Two or more professional cheaters, for example, can gang up on a good player to reduce his edge odds to a losing level. The good player, however, quickly detects team or gang cheating and either beats it or eliminates it or quits the game (see Chapter XXXI).

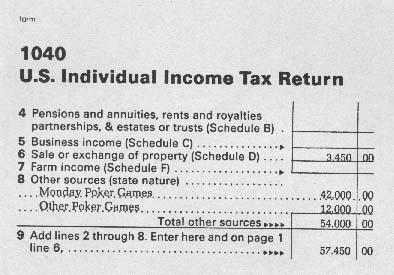

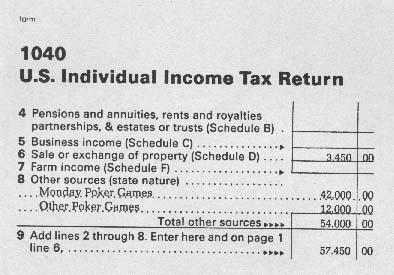

For federal tax purposes, net annual poker winnings must be declared as income.[ 21 ] Poker income can be listed under the heading of "Other" on Federal Income Tax Form 1040. In most states, net poker gains can also be declared as income. Gambling losses can be deducted (on Schedule A) from poker income, but net gambling losses cannot be deducted from taxable income.

Poker players' winnings are not subject to the federal excise taxes on gambling.[ 22 ] Apparently the federal government does not classify poker players as gamblers (even though poker income is treated as gambling gains by the IRS).

A survey by the author (summarized in Table 23) shows that poker games are technically illegal in most states. Nevertheless, few if any states apply their anti-gambling laws to private poker games. But house games (in which pots are cut or raked for a profit or during which players pay collection fees) are vulnerable to legal action in most states.

Table 23 gives information about the legal and tax status of poker in each state.

| State-- Is Poker Legal?* | Source of Information-- Legal Reference | State Income Tax 1980 |

| No | NAACP of Montgomery, Alabama-- Alabama State Statutes | |

| No | Bar Association Section 11.60.140 | |

| No | Bar Association-- Revised Statutes 13.431 | |

| No | Assistant Attorney General-- Statutes Annotated 41-2011 and 3809 (Repl. 1964) | |

| No | Deputy Attorney General-- Penal Code 330: Refers only to stud poker as illegal | |

| No | Bar Association-- Revised Statutes, Section 40-10-9 | |

| No | State Police-- Sections 53-272-277 | |

| Yes | Assistant Attorney General-- Title II Code of 1953. Section 665 | |

| No | Attorney General-- Section 849.08 | |

| No | Assistant Attorney General-- Georgia Code, Section 26-6404 and 6401 | |

| No | Bar Association-- No specific reference given | |

| No | Assistant Attorney General-- Section 18-3801, Idaho Code | |

| No | Legislative Reference Bureau-- Criminal Law, Chapter 38, Section 28-1 | |

| No | Bar Association-- Act of 1905, Chapter 169, Statute 10-2307 | |

| No | Solicitor General-- Chapter 726, 1966 Code | |

| No | Bar Association-- No specific reference given | |

| No | Bar Association-- No specific reference given | |

| Yes | Republican Party of Louisiana-- No specific reference given | |

| No | Assistant Attorney General-- Revised Statute 1964 | |

| No | Assistant Attorney General-- Maryland Article 27, Section 237-264 | |

| No | Bar Association-- Section 1, Chapter 37, General Laws | |

| No | Democratic State Central Committee of Michigan-- Penal Code, 1945, Sections 750.314 and 750-315 | |

| Yes | Attorney-- Statutes 609, 75 | |

| No | Bar Association-- Code of 1942, Section 2190 | |

| No | Governor-- State Statute | |

| No | Attorney General-- Section 94-2401, R.C.M., 1947: Licensed poker clubs only | |

| Yes | Bar Association-- No specific reference given | |

| Yes | Bar Association-- No specific reference given | |

| No | Bar Association-- 577.7 Gaming | |

| No | Deputy Attorney General-- Statutes 2A:112-a and 218:85-7 | |

| No | Assistant Attorney General-- Section 40A-19-1 to 3, N.M. Statutes Annotated, 1953 Compilation (P.S.) | |

| No | Assistant Council to Governor-- Article 1, Section 9 of N.Y. State Constitution, and Sections 970-998 of N.Y. State Penal Law | |

| No | Bar Association-- No specific reference given | |

| No | Bar Association-- Chapter 12-23-01 | |

| No | Bar Association-- Section 2915.06, Revised Code | |

| No | Oklahoma State University-- Title 21 of Oklahoma Statutes, 1961, Section 941 | |

| No | Attorney General-- ORS 167.25 and 167.510 Licensed poker clubs only | |

| No | Deputy Attorney General-- No specific reference given | |

| No | Attorney General's office-- No specific reference given | |

| No | Research Clerk-- Sections 16-804, 505 | |

| No | Bar Association-- No specific reference given | |

| No | Attorney General-- Section 39-2001, Tennessee Code Annotated | |

| Yes | Governor-- Texas Jurisprudence, 2nd volume 26 | |

| No | Attorney General-- Section 76-27-1 to 3, Utah Code Annotated, 1953 | |

| No | Bar Association-- Section 2132 and 13, VSA 2133 | |

| No | Attorney General-- Section 18.1-316 | |

| No | Assistant Attorney General-- Revised Code 9.47.010-9.47.030: Licensed poker clubs only | |

| No | Bar Association-- No specific reference given | |

| No | Bar Association-- Chapter 945 | |

| No | Attorney-- Statute 6-203, 1957 | |

| ? (not clear) | United States Attorney-- Title 22, D.C. Code, Sections 1501-1515 | |

| No | Bar Association-- No specific reference given | |

| No | Attorney-- Sections 1221-1226, Chapter 61, Title 14 | |

| Yes | Deputy Attorney General-- Legality is up to individual states. Winnings are taxable income. | |

This section of the 1040 Federal Tax form shows how John Finn declared his $54,000 poker income over a decade ago.[ 23 ]

[ 20 ] See Chapters XXIX-XXXI for details about undetectable, professional cheating.

[ 21 ] Carmack v. Commissioner of Internal Revenue. 183 E 2d l (5th Cir. 1950).

[ 22 ] According to the United states Excise Tax Regulation 4401 (paragraphs 4020-4032) poker winnings are not subject to the 10 percent excise wagering tax. And according to Regulation 4411 (paragraphs 4075-4083) poker players, even professional players, are not required to register and purchase the wagering Occupational Tax stamp.

[ 23 ] 1965 is the last year John Finn's poker records and tax returns were made available. With inflation and expanded poker action, John Finn's annual poker income is estimated at $200,000 for 1980.

Disclaimer - Copyright - Contact

Online: buildfreedom.org | terrorcrat.com / terroristbureaucrat.com